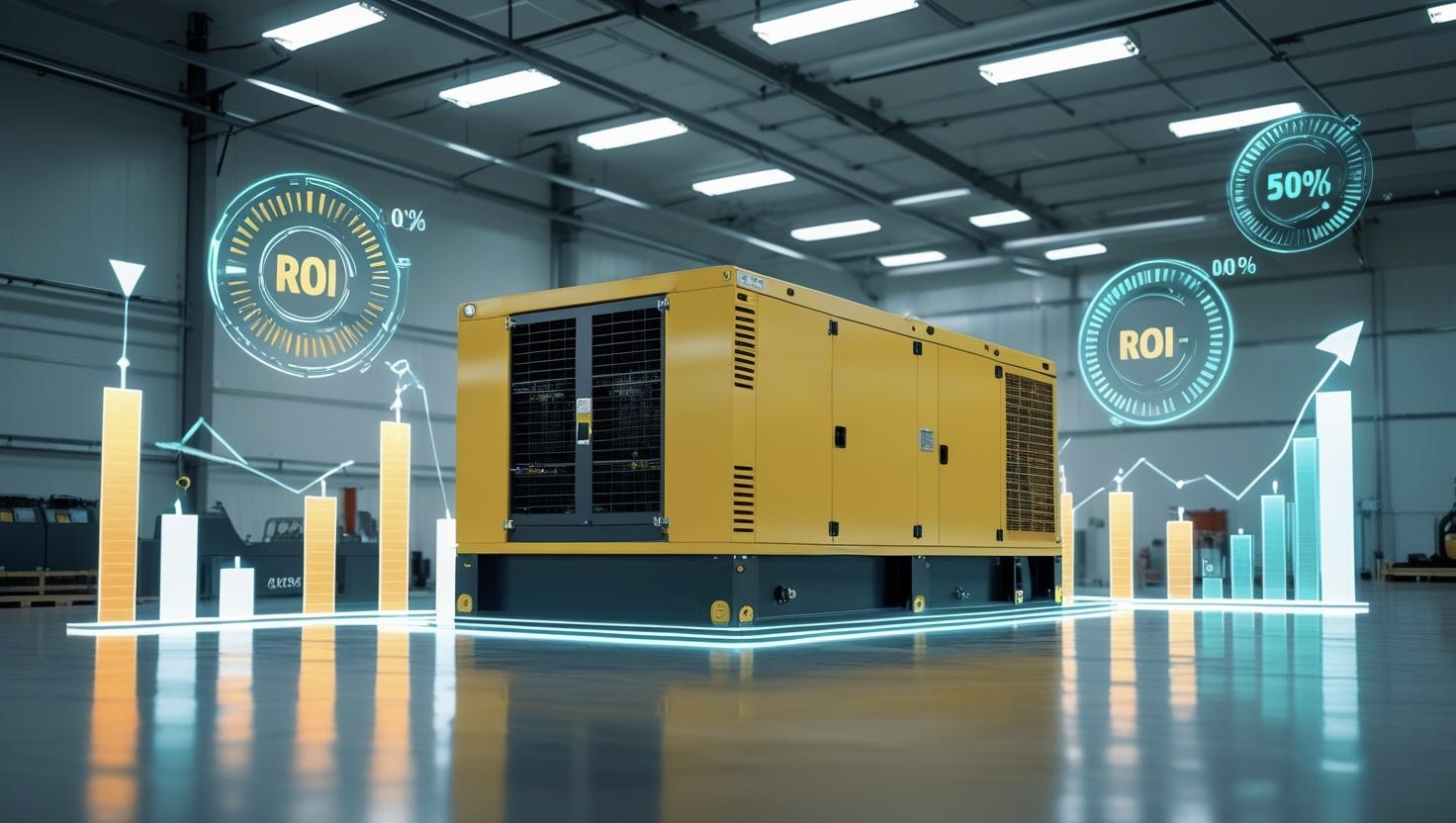

How to Measure the Return on Investment (ROI) for Equipment

Investing in equipment is a major financial decision for businesses in industrial, construction, and manufacturing sectors. To evaluate whether this decision was profitable, it’s essential to calculate the Return on Investment (ROI) accurately.

Here’s how to measure ROI and make smarter equipment investment decisions.

1. Calculate Total Costs

Begin by identifying all expenses associated with the equipment:

- Purchase or rental cost

- Transportation and installation

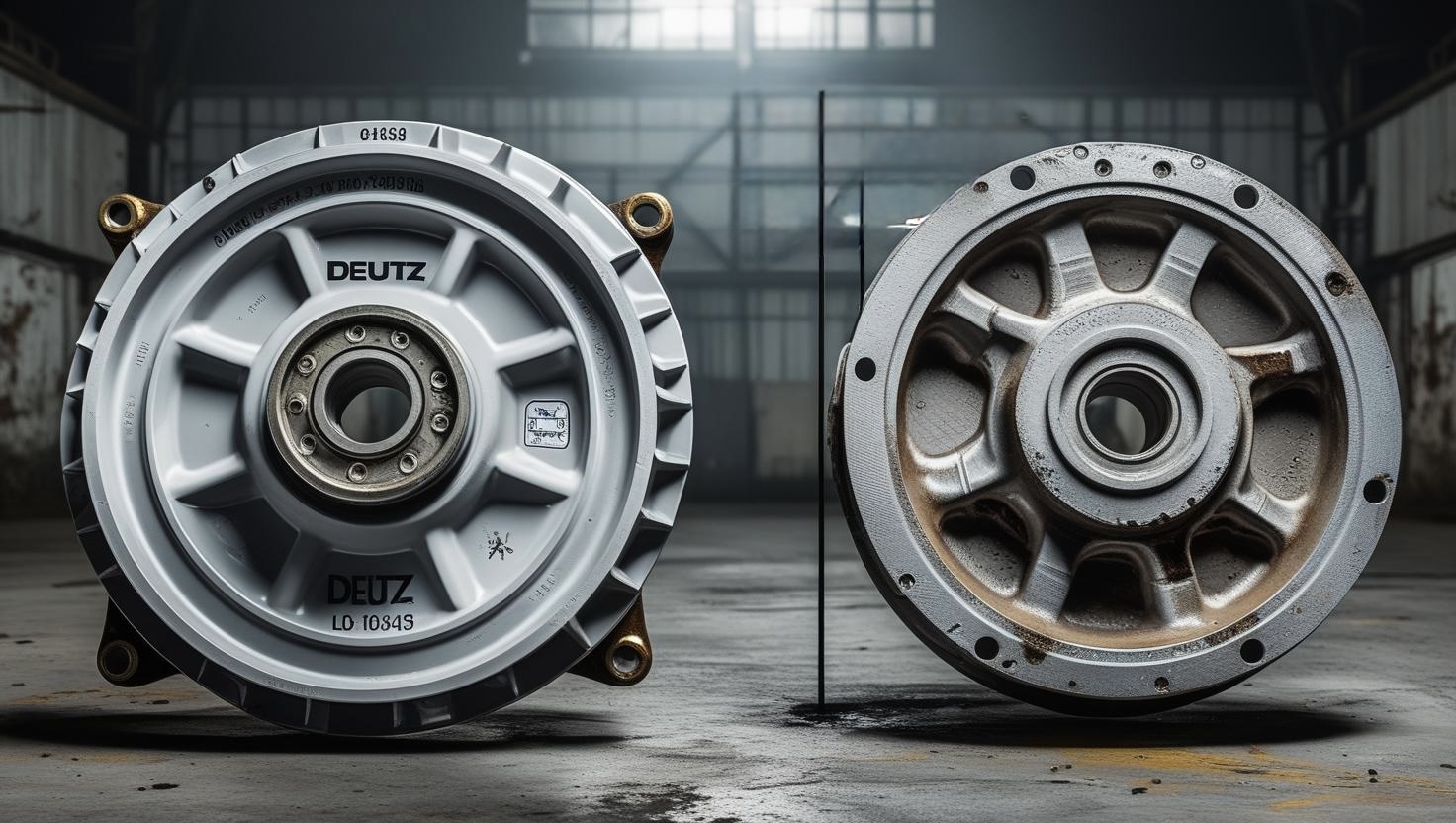

- Maintenance and spare parts

- Fuel and operator costs

- Training or operational support

This gives you the total cost base of the equipment.

2. Measure Financial Gains and Savings

Next, determine the financial returns from the equipment:

- Increased productivity or output

- Labor savings

- Faster project completion

- Cost avoidance (e.g., renting long-term vs. buying)

Atlas clients often achieve higher efficiency and cost savings with the right equipment strategy.

3. Use the ROI Formula

The basic formula is:

ROI (%) = [(Return – Cost) / Cost] × 100

Example:

- Total cost: 50,000 AZN

- Annual return or savings: 70,000 AZN

ROI = [(70,000 – 50,000) / 50,000] × 100 = 40%

Meaning: The investment generated a 40% return within one year.

4. Consider the Payback Period

Don’t just look at percentage — time matters too:

- A high ROI over 5 years may be risky

- A lower ROI with a 1–2 year payback is often more practical

Atlas experts can help estimate your equipment’s payback timeline.

5. Compare with Alternative Investments

What if you invested the same money elsewhere?

By comparing ROI with other options (leasing, outsourcing, etc.), you can objectively assess if equipment investment is truly worthwhile.

Conclusion

ROI isn’t just a number — it’s a strategic tool that helps you:

- Choose equipment wisely

- Justify budgets and proposals

- Predict long-term value

At Atlas, we support you with:

- Expert equipment selection

- ROI forecasts

- Investment analysis tools

Contact us:

+994 51 232 55 55